Financial Markets Plunge Amid Fears of Global Recession

The global economy is facing one of its most challenging times in recent memory. Financial markets all around the world have been experiencing a significant plunge, with investors fearing a global recession. The current economic landscape has been significantly impacted by several key factors, which have contributed to this alarming downturn.

The widely-discussed trade tensions between the United States and China have been a primary driver of these market fluctuations. The two economic powerhouses have been locked in a trade war, imposing tariffs on each other’s goods and disrupting global supply chains. The uncertainty surrounding this conflict has led investors to adopt a cautious approach, withdrawing investments and causing markets to spiral downwards.

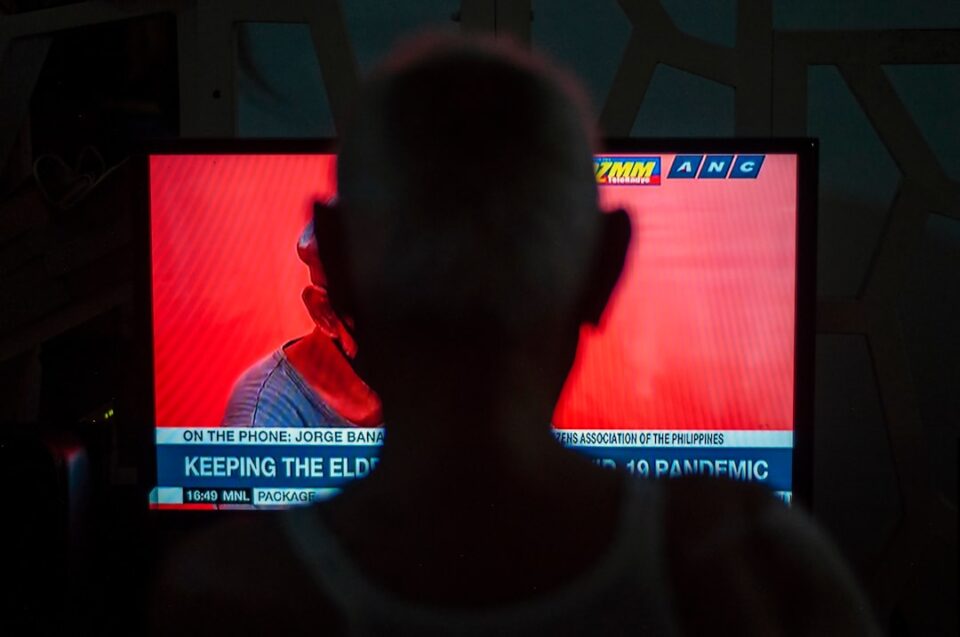

Amidst this already tense situation, the outbreak of the COVID-19 pandemic has dealt an unprecedented blow to the global economy. The rapid spread of the virus has resulted in the imposition of lockdown measures, widespread shutdowns of businesses, and a decline in consumer demand. The severe disruption to both the supply and demand sides of the global economy has magnified the concerns of investors, resulting in further market plunges.

In addition to the trade war and pandemic, the reduction in global oil prices has added to the financial turmoil. A rift between major oil-producing nations, notably Saudi Arabia and Russia, led to a failure in reaching an agreement to cut production levels. Consequently, an oil price war ensued, causing oil prices to plummet to record lows. The dramatic drop in oil prices has triggered panic and uncertainty within financial markets, as the energy sector faces serious consequences, impacting various other industries as well.

The consequences of these intertwined crises on financial markets have been devastating. Major stock indices worldwide have seen substantial declines, wiping out trillions of dollars’ worth of market value. Volatility, uncertainty, and fear have become the norm, prompting investors to shed riskier assets in favor of safe-haven investments such as gold and government bonds. Central banks have had to step in, implementing emergency measures such as interest rate cuts and injecting liquidity into markets, in an attempt to stabilize the situation.

The impact of this financial turmoil is not limited to the stock market. The credit market, which plays a crucial role in funding businesses and individuals, is also experiencing significant strain. Many companies are facing difficulties securing financing, leading to concerns over their financial viability and potential bankruptcies. This credit crunch can have far-reaching consequences, affecting employment rates, consumer spending, and overall economic growth.

While the situation seems grim, it is important to remember that financial markets are highly sensitive to global events and sentiment can change quickly. It is crucial for both investors and policymakers to adopt a long-term view, considering the potential for recovery and the lessons learned from past crises.

Governments around the world are recognizing the severity of the situation and implementing stimulus packages to support struggling economies. Central banks continue to deploy unconventional measures, including large-scale asset purchases and direct lending programs, to help mitigate the impact of the crisis. By injecting liquidity into the system, they aim to restore confidence and provide stability to financial markets.

Furthermore, as the global community grapples with the COVID-19 pandemic, medical advancements and the distribution of vaccines offer hope for a gradual return to normalcy. Once the health crisis is under control, economies are likely to rebound as pent-up demand is unleashed, particularly in sectors such as travel, hospitality, and entertainment, which have been severely affected.

Investors should take a well-informed and measured approach during these turbulent times. Diversification and a focus on long-term goals can help ride out the market volatility. Consulting with financial advisors and staying updated on market developments can provide valuable insights and guidance.

While the current financial market plunge is undoubtedly unsettling, it is essential to remember that economies have faced and overcome crises before. By learning from past experiences and implementing sound economic policies, there is a strong possibility for recovery and future growth. In these uncertain times, it is crucial for global leaders and policymakers to work collectively, fostering cooperation and instilling confidence in the global economy.